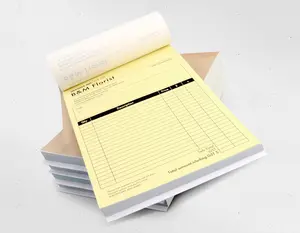

Introduction to Print Bill Book

A print bill book is an essential business tool for managing transactions, providing a clear and professional means of documenting sales and services rendered. From small businesses and retail shops to larger organizations, a well-structured print bill book streamlines the invoicing process, enhances customer trust, and improves internal record-keeping. With a variety of options available, understanding the specific types and features of a print bill book can significantly impact your operational efficiency.

Types of Print Bill Books

There are several types of print bill books tailored to suit various business needs:

- Standard Print Bill Books: These are traditional format books, often spiral-bound, that allow for manual entries. They are cost-effective and perfect for small operations.

- Duplicate Print Bill Books: Useful in situations where a copy of the bill is required. These books allow for a carbon copy to be created, ensuring records are maintained simultaneously.

- Triplicate Print Bill Books: Functioning similarly to duplicate options, triplicate books provide three copies of each bill—one for the customer, one for the seller, and one for accounting purposes.

- Customized Print Bill Books: Businesses can opt for personalized print bill books to reflect their branding. These can include logos, specific color schemes, and tailored layouts to fit the business style.

Function and Feature of Print Bill Book

Understanding the key functionalities and features of a print bill book is crucial before making a purchase decision:

- Professional Documentation: A print bill book provides an official document that can be presented to customers, enhancing the professionalism of your business.

- Customizable Templates: Many print bill books offer the option to customize templates, ensuring that businesses can add their specific branding elements.

- Carbon Copy Options: Duplicate and triplicate formats serve to provide seamless record-keeping without the need for excessive digital resources.

- Durable Material: Quality print bill books are often made with sturdy paper and binding materials, ensuring they withstand regular use.

Applications of Print Bill Books

Print bill books serve a variety of applications across different sectors:

- Retail: Retail businesses utilize print bill books for sales transactions, receipts, and customer records, fostering customer confidence.

- Service Industries: Services such as salons and repair shops can effectively use print bill books to keep track of services rendered and payments received.

- Commercial Transactions: Wholesale distributors and manufacturers benefit from print bill books for documenting bulk transactions and simplifying inventory management.

- Event Management: Event planners can leverage print bill books for tracking vendor payments and client invoices, ensuring all transactions are easily traceable.

Advantages of Using Print Bill Books

The use of a print bill book brings numerous advantages that can enhance operational efficiency:

- Streamlined Processes: Having a dedicated bill book simplifies transaction recording, reducing the possibility of errors that can occur with electronic systems.

- Cost Efficiency: Print bill books are often less expensive than digital invoicing systems, especially for small businesses with limited budgets.

- No Technical Learning Required: Anyone can use a print bill book with minimal training, making it user-friendly for staff at all levels.

- Physical Record Keeping: Maintaining hard copies is beneficial for legal purposes, tax documentation, and audits, providing an extra layer of security over purely digital records.

Ready to Ship

Ready to Ship